hi everyone today in this video i will instantly compare car insurance quotes 2022 so let's get started

first of all before I start I want to show you some points that I have covered in this video then

first point is all you need to compare car insurance second how to compare car insurance cards find the right policy third point is what is the best car insurance comparison site fourth point is how much does car insurance cost fifth point is to compare cheap auto insurance teams six point eight compare car insurance scores by state seven point eight compare current solar scores for each eighth point is compare currency scores based on driving history ninth point is compare .

car insurance teams for driver's credit score, and the last point is to compare the cost of car insurance based on the final model of the car, so keep looking.

our first point is all you need to compare car insurance so if you are buying car insurance for the first time or if you have had the same policy for years compare the rates of different providers in an important part of the search of a great deal to facilitate the process injurify experts have developed a guide to help you understand what's in your quad and find the cheapest option for you two pets here q friends here the first factor.

the average American driver pays $ 136 a month or what makes a thousand in $ 632 a year for auto insurance but those who compare quartz before buying a policy can save up to $ 996 a year if drivers with record clean p9 29 percent less for car insurance on average than drivers with driving violations recorded violations and third point third

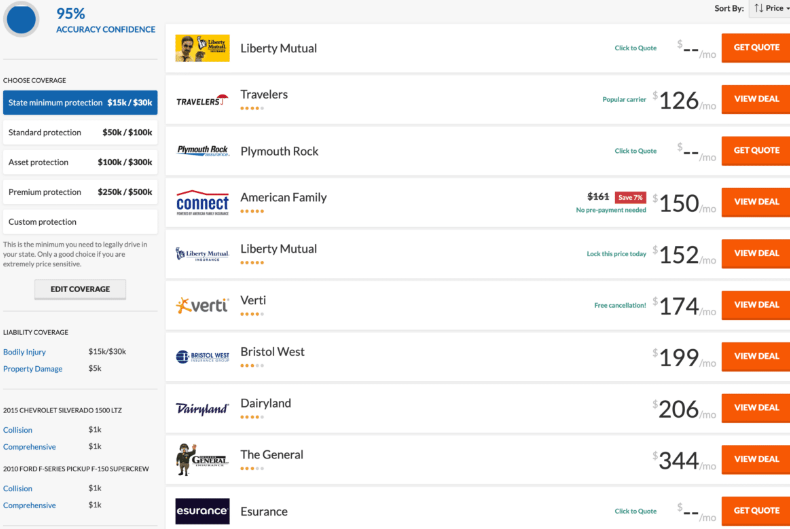

traverse factor is the cheapest auto insurance provider across the country with an average auto insurance cost of $ 65 per month, our second point is how to compare auto insurance course auto insurance the right policy drivers claim that trying to make smarter decisions their car insurance decisions can compare course by taking these simple steps these days the first step is to gather the information you need to receive an accurate quote and the second step is to use an insurance comparison platform like in certificate to view a list of personalized insurance calls

the third step is to compare the policies and choose the one that offers you the best deal for your coverage and the fourth step is alternatively you can talk to one of the independent agents you had as you like to talk to a licensed professional then our third step is what is the best auto insurance comparison site so the best auto insurance companies inside tend to be a site that provides users with accurate and authentic parts like insulify according to jabra third jury

so in order to get the information you are looking for these sites may ask you for a variety of information to get UK an accurate court this therefore includes your car your cars make model and year your age your maternal sex your maternal and working status your address and if you own a home and your credit score education level and driving record then in these points I have to cover in this video and the next so our fourth point is how much car insurance costs then based on the incentive I think the national average cost of auto insurance is 136 per month but how much you pay for auto insurance is

highly dependent on factors such as your location coverage and driving history, e.g. drivers at a messenger pace there's the 75% of the national average and drivers with a fault and record crash pay 90 laps 29 above the national average the question you should ask is q hen so how much should i pay for car insurance and of course the answer is the lowest possible amount the current insurance is 15 monthly expenses you have to pay as long as you plan to drive a car there is no reason to pay more

than it takes to find the best way to find the cheapest auto insurance policy available for you is by procuring cars from multiple insurance providers and identifying the one that offers you the best deal acquired comparison site like Insertify insulify makes it incredibly easy by providing you with any experience Comprehensive Tolerated Comparison of Discounts and Tips on Coverage and Fifth Point Coverage is to compare cheap auto insurance teams in mI hear insurance costs as unique as you are which is why comparing multiple cars is important to find the best rate when using an insurance cost comparison tool you can be sure that you have found the cheapest card for the best couples who find the lowest lowest monthly date will depend on a variety of factors, including which company you choose your coverage level

manages your auto insurance with other types of insurance the price of your what discounts do you qualify for so in general you wanted to find a quad with the best company possible that you are still comfortable paying month to month keeping costs low shouldn't To come to the price of adequate and required coverage, our sixth step is to compare auto insurance by state, then including the company you choose your coverage level that manages your auto insurance with other types of insurance the price of your what discounts you qualify then in general you wanted to find a quad with the best possible.

company that you are still comfortable paying month-to-month while keeping costs low shouldn't To come up with the price of adequate and required coverage our sixth step is to compare insurance cars by state, so including them the company you choose your coverage level that manages your auto insurance with others types of insurance the price of your what discounts do you qualify for so in general .

you wanted to find a quad bike with the best possible company that you are still comfortable paying month to month keeping costs low shouldn't To come at the price of adequate and required coverage, the our sixth step is to compare insurance cars by state, then our sixth step is to compare insurance cars by state, so our sixth step is to compare insurance cars by state, so the

Insurance companies heavily have every wave and create the state you live and drive in because and variables like population density, crime rates and weather patterns affect your vehicle your driving habits and your likelihood of flying make a climb so menchvan is the most expensive state for auto insurance with residents averaging over 230 38 per month per capita sembic and ship auto auto .

auto provide Mexican residents with the cheapest auto insurance policies on average um meanwhile abali avalia is l '' cheapest auto insurance with residents spending an average of 69 per month on auto insurance farmers provide the cheapest auto insurance policy in hawaii even where where you live in your state can affect your monthly auto service payment city the city dollars will almost always pay more than a super for bur and rural drivers more people mean more to car and traffic ,increasing attacks and threat or accident and releasing frequently exposed extreme weather fluids, fires and

otherwise even drivers can expect to pay higher premiums state insurance company an average cost of auto insurance here you can see the state of alaska and middle tier insurance company home and auto and average cost of auto insurance and 96 and national general insurance company of alabama and $ 64 average cost insurance um cost so arachnois conti was progressive $ 69 arizona meter while $ 45 45 california meter mile $ 61 colorado sun cost 87 uh connected Connecticut , camper favorite company $ 81 bankston dc travelers travelers company and 1993 medieval owned car delivery $ 131 average cost for auto insurance and florida american company precision our seventh step is to compare car insurance costs by age insurance costs vary greatly with age. age teenage drivers have the most expensive car insurance premiums i of any age group in any state and drivers under 25 are generally classified and high risk drivers

Insulin insurance becomes cheaper with age and they can earn more expenses more and more experience on the world's drivers in their space 30 30 nearly 50 55 percent less than less than 10 drivers and drivers in their space on 40 years even less after record-breaking cars on the road older drivers between 50 and 60 benefit from the cheapest auto insurance rates of any age group on average 60-year-old drivers with a clean record can expect to pay the 65% less than in 88 years, however, will increase again once the driver reaches 80 drivers in their atsp about 21% more of their insurance policy a older cars

overall stains are the most expensive type of car installed while in medieval minivans they are the cheapest, so the top three cheapest carbon coals to guarantee in the US are fleet freight risk and through these these car brands are known for their cheap price and structural dependence which is reflected in their current lower lower insurance rates on the other hand the more expensive car brands to ensure the inclusion of the alpha tax alpha but not only are they not only expensive for the purpose, but their , insurance premiums will cost you thousands of dollars every year, so friends if you have any kind of doubt regarding these points then please write yours please write in the comment box and share this video with yours

best friend so if you have not subscribed please subscribe to this channel to see more videos like this then see you next time subscribe in the comment box and share this video with your best friend so if you have not subscribed in any way subscribe to this channel to see more videos like this then see you next time subscribe in the comment box and share this video with your best friend so if you have not subscribed in any way subscribe to this channel to see more videos like this then see you at next video